Marketing

Annual report JSOC Bashneft 2013

74

Financial results

Annual report JSOC Bashneft 2013

75

ABOUT

THE COMPANY

OPERATING RESULTS

APPENDICES

CORPORATE GOVERNANCE

INFORMATION FOR

SHAREHOLDERS AND INVESTORS

Wholesale and small wholesale

In 2013, wholesale sales of petroleum products and petro-

chemicals (including small wholesale) totalled 9.2 million

tonnes.

The Group’s branch Bashneft–Regional Sales (previously LLC

Bashneft–Region, a marketing subsidiary) is responsible for

small-scale wholesale distribution of petroleum products.

The unit controls a network of regional sales offices that de-

liver products from the Ufa refineries to more than 30 regions

of Russia.

Bashneft is actively expanding its network of marketing en-

terprises in order to increase small-scale wholesale supplies

of motor fuel in priority regions. These include mostly regions

bordering Bashkortostan, as well as Moscow and St Petersburg,

as themost intensivemarkets in terms of consumption volumes.

In 2013 Bashneft continued development of wholesale chan-

nels. In accordance with the requirements of the Ministry

of Energy and the Federal Antimonopoly Service of Russia,

and in order to improve transparency, petroleum product sales

via the St Petersburg International Mercantile Exchange were

significantly increased. Total sales on the exchange in 2013

came to 960 thousand tonnes of petroleum products.

Oil product exports in 2013

Pipeline

Rail

Ship

98%

13%

69%

2%

87%

31%

0%

20%

40%

60%

80%

100%

Fuel oil

Diesel

Fuel oil

Exports of petroleum products

In 2013, Bashneft exported 9.4 million tonnes of petroleum

products and petrochemicals. More than 90% was sold

to countries outside the Customs Union, mainly to Northern

Europe. Sales to Customs Union countries totalled 0.7 million

tonnes.

The main export product is diesel fuel (53% of supplies). Vac-

uum gas oil and fuel oil also have significant share (19% and

16% respectively).

The Group exported its petroleum and petrochemicals via

OJSC Transnefteprodukt’s system of export pipelines, by rail

to Kazakhstan and European countries, and through ma-

rine terminals to ports in St Petersburg, Vysotsk, Novoros-

siysk and Kaliningrad. It also shipped products at the buyer’s

expense to Europe by road. During the navigating season,

in 2013 fuel oil was shipped from Ufa via water transport.

To organise this, moorings were prepared for handling and

filling.

In 2013, fuel oil was mainly supplied by rail freight (about 69% of the total), and the rest by water. Diesel fuel was transported

by pipeline, and petrol mainly by rail (87%).

Exports of petroleum products and petrochemicals, million

tonnes

2011 2012 2013

Share

in

2013

Diesel fuel

5.3 5.0 4.9 52.7%

Vacuum gas oil

1.9 1.6 1.8 18.7%

Fuel oil

1.0 1.0 1.5 16.0%

High-octane petrol

0.4 0.5 0.7 7.6%

Naphtha

0.4 0.1 0.1 1.3%

Petrochemicals

0.1 0.1 0.1 1.1%

Other

0.1 0.2 0.3 2.7%

Total

9.2 8.6 9.4 100.0%

Financial results

In 2013, Bashneft again delivered a positive financial perfor-

mance. Increases in revenue and EBITDA were driven by or-

ganic growth of oil production, upgrades to production facili-

ties, an increase in the share of production of Euro-4 and Euro-5

fuels, optimisation of the sales structure and implementation

of our strategic goals to simplify the Group’s structure and im-

prove corporate governance.

Despite the weak price dynamics in foreign markets, revenue

increased by 5.8% in 2013 year on year and reached RUB 563

billion, due to higher oil production and refining volumes and

higher domestic prices for petroleum products.

Petroleum products and petrochemicals accounted for the bulk

of revenue, with a 78% share, supporting greater sales margins.

In terms of the geography of petroleum products and petro-

chemicals sales, export and domestic supplies are distributed

in roughly equal proportions, helping to balance price dynamics

in different markets and exchange-rate fluctuations.

Oil sales account for 20% of revenue, comprised mainly of ex-

port sales.

In 2014, we expect the completion of two final projects to sup-

port production of Euro-4 and Euro-5 fuels; further down the

road, by 2018-19 we anticipate completing projects to increase

refining depth, which will help further increase sales of prod-

ucts with high added value.

In absolute terms, EBITDA grew by 2.5%, with an EBITDA mar-

gin of 18%. EBITDA was affected by an increase in non-control-

lable costs in the tax burden, primarily MET and export duties,

due to increase export volumes to countries which are not part

of the Customs Union. It was also affected by higher unit costs

for production related to the expansion of exploration and seis-

mic surveys and the high cost of oil production in the early de-

velopment phase at the Trebs field.

Capital investments remained at the 2012 level and amounted

to RUB 30.4 billion. Development of the Trebs andTitov fields

and upgrade works at refining facilities remain the main items

of capital expenditure.

Capital investments, RUB millions

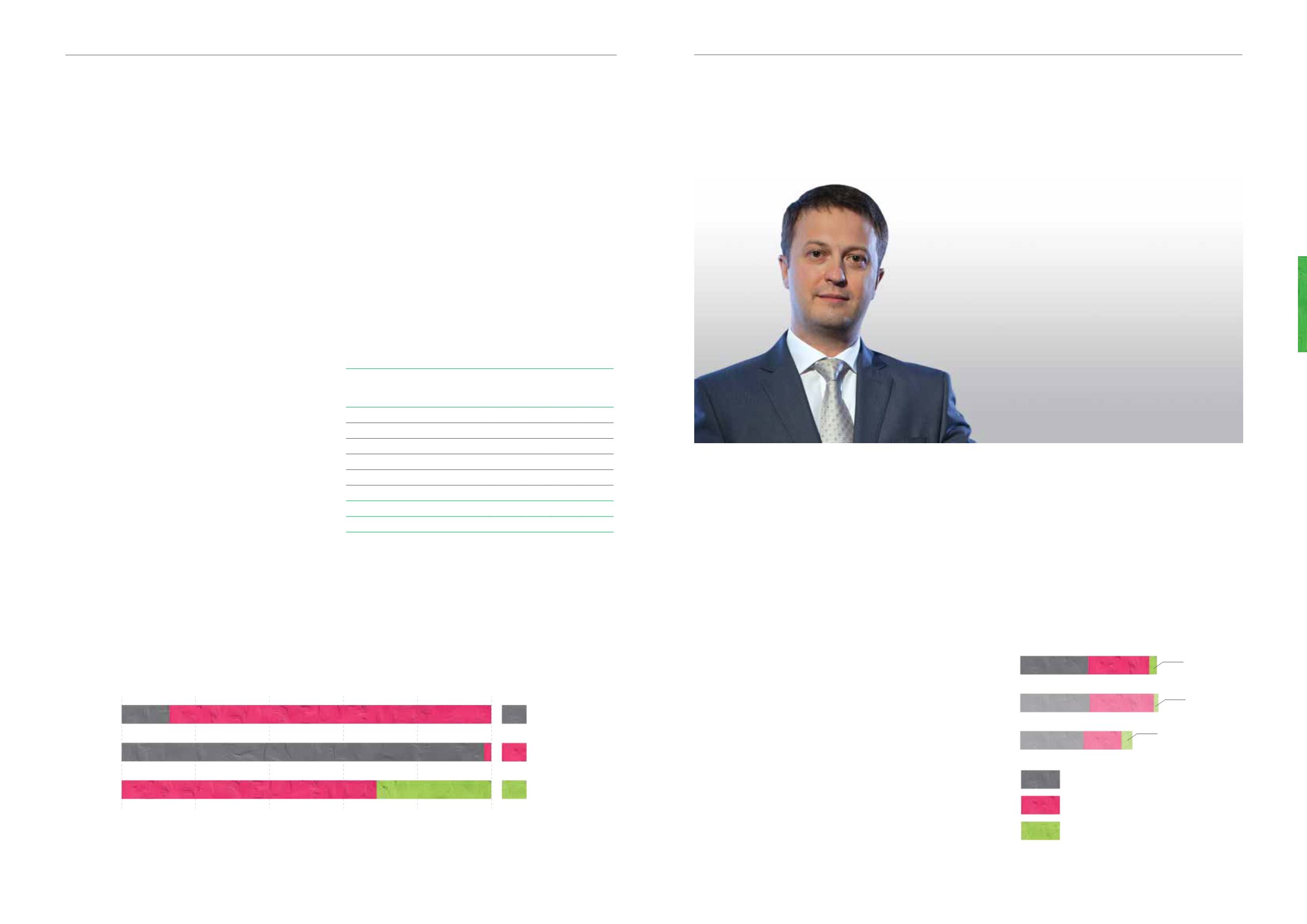

2013 was a very successful year for

the Company, financially. We demon-

strated robust growth across our fi-

nancial metrics, once again increas-

ing our revenues and net profit, while

lowering our leverage. Our ROACE

reached 24%.

Denis Stankevich

Member of the Management Board,

Vice President, Economics

and Finance – Chief Financial Officer

”

2011

2012

2013

1,027

1,715

30,441

30,789

25,007

2,432

Downstream

Upstream

Other

15,464

15,144

14,298

14,113

8,462

13,582