Changes to the Group’s structure

84

Changes to the Group’s structure

85

Annual report JSOC Bashneft 2013

Annual report JSOC Bashneft 2013

ABOUT

THE COMPANY

APPENDICES

INFORMATION FOR

SHAREHOLDERS AND INVESTORS

OPERATING RESULTS

CORPORATE GOVERNANCE

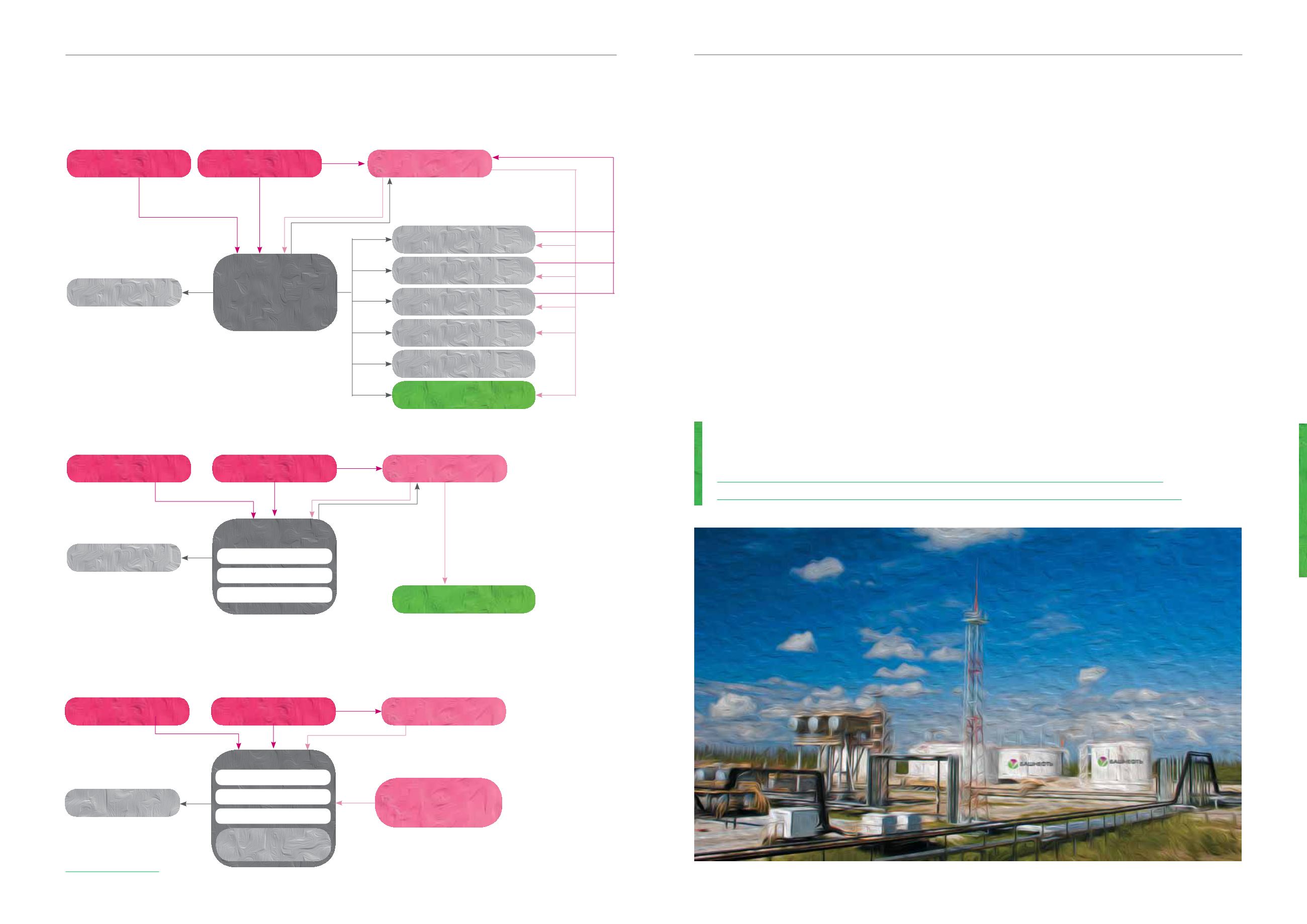

Target Group structure following the third phase

of the reorganisation (elimination of cross shareholdings)

Note: Percentage of share capital.

Percentage of ordinary shares shown

additionally in parentheses.

19.9% (11.5%)

Group structure (following first and second phases of reorganisation)

Note: Percentage of share capital.

Percentage of ordinary shares shown

additionally in parentheses.

25.24% (30.24%)

Group structure before reorganisation

17

Note: Percentage of share capital.

Percentage of ordinary shares shown additionally in parentheses.

17. As of 31 December 2011.

Bashneft-Polyus

Ufaneftekhim

50.60%

50.60%

27.0% (13.7%)

74.9%

52.10% (61.3%)

20.9% (25.0%)

54.9%

(65.7%)

61.8%

(67.4%)

(62.7%)

56.3%

56.9%

(61.4%)

(100%)

94.0%

56.5%

(65.3%)

21.50%

(24.90%)

17.2%

(18.6%)

22.5%

(25.5%)

25.6%

(28.2%)

18.2%

(22.4%)

8.1%

(8.1%)

7.3%

(7.3%)

7.3%

(7.3%)

26.7% (26.7%)

Novoil

Ufa Refinery

Bashkirnefteprodukt

Orenburgnefteprodukt

Ufaorgsintez

Minorities

JSFC Sistema

CJSC Sistema-Invest

JSOC Bashneft

Bashneft-Polyus LLC

50.60%

50.60%

21.01% (10.68%)

74.9%

50.10% (57.26%)

49.40% (49.40%)

21.50% (24.90%)

Ufaorgsintez OJSC

Minorities

JSFC Sistema

CJSC Sistema-Invest

Upstream

JSOC Bashneft

Refining

Marketing

Bashneft-Polyus LLC

100%

74.9%

63.3% (71.8%)

10.7% (12.6%)

4.6%

(2.3%)

Shares owned

by Bashneft

subsidiaries

Minorities

JSFC Sistema

CJSC Sistema-Invest

JSOC Bashneft

Treasury stock 1.5%

(1.8%)

Upstream

Refining

Marketing

Transition to a single Bashneft share

We are now a fully integrated oil company

The initial step in enhancing the corporate structure was the

transition to a single Bashneft share in 2012, through the

consolidation of the five largest subsidiaries into the Group.

The legacy corporate structure had meant that the Group was

unable to achieve all of its strategic goals in corporate gover-

nance. As a result of the reorganisation, Company manage-

ment was able to materially increase the Group’s efficiency

across all of its business segments.

In March 2012, the Board of Directors, and subsequently the

AGM of JSOC Bashneft and its subsidiaries, approved the

terms for the merger. At the end of June 2012, JSOC Bash-

neft and its subsidiaries participating in the reorganisation

fulfilled their obligations to buy out shares. The total sum al-

located by these subsidiaries for the buyout amounted to RUB

19.034 billion. In October 2012, JSOC Bashneft completed

reorganisation through consolidation of five subsidiaries with

the Company. The Group received notification that these sub-

sidiaries ceased to exist as legal entities and exchanged its

subsidiaries’ shares for shares in JSOC Bashneft.

Enhancing corporate structure through the transition

to a single Bashneft share meant that stockholders were now

able to participate in the financial results of the Company

as a whole and not just in certain subsidiaries.

JSOC Bashneft was transformed into a single operational de-

cision-making centre for all of the Company’s business seg-

ments: upstream, refining, and marketing.

Integration of subsidiaries led to an optimised Group struc-

ture and the formation of a truly vertically integrated com-

pany. As part of the transition to a single share, the Company

succeeded in increasing share liquidity and protecting minor-

ity shareholders’ rights while simultaneously reducing tax

risks for the Group.

As part of the reorganisation the Group issued additional shares. Read more about

the reorganisation process on Bashneft’s website: