Dividend policy and distribution

96

Information disclosure and investor relations

97

Annual report JSOC Bashneft 2013

Annual report JSOC Bashneft 2013

ABOUT

THE COMPANY

APPENDICES

INFORMATION FOR

SHAREHOLDERS AND INVESTORS

OPERATING RESULTS

CORPORATE GOVERNANCE

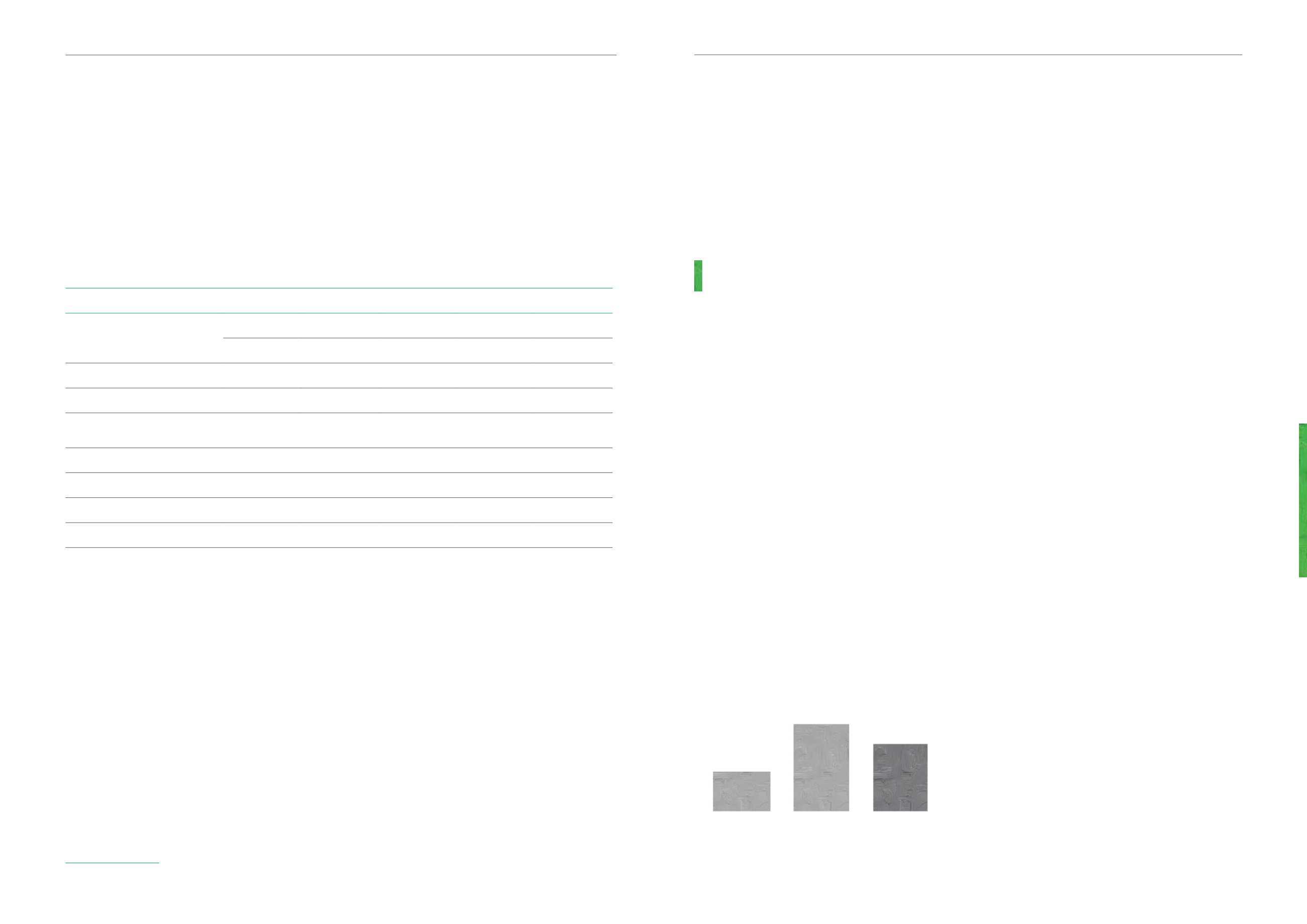

Accrued dividends for the financial periods 2010 through 9M 2013

Period

2010

2011

2012

9M 2013

Type of share (RUB per share)

Ordinary

235.77

99.00

24

199

Class A Preferred

235.77

99.00

24

199

Total number of shares

204,792,440

204,792,440

227,384,465

227,384,465

Total amount, including dividends for Group subsidiaries, RUB 48,283,894,664.30 20,274,451,560.00 5,323,724,500.00 45,249,508,535.00

Total expenditures to buy back shares of the Company and its

affiliates as part of the reorganisation in 2012, RUB

-

19,034,000,000

-

-

Portion of income under IFRS, %

112.4%

40.7%

10.2%

137.9%

21

Total cash dividend payout ratio, %

-

78.9%

97.1%

22

Decision to pay dividends

AGM, 29.06.2011 AGM, 29.06.2012 AGM, 27.06.2013 AGM, 17.12.2013

Deadline for payment of accrued dividends

By 08.08.2011

By 28.08.2012

By 26.08.2013

By 15.02.2014

21. Ratio calculated on the basis of net profit for the first 9 months of 2013.

22. Including dividends relating to results for 2012 and interim results for 9M 2013.

Dividend payout (as a percentage of IFRS net profit) de-

creased from 40.7% in 2011 to 10.2% in 2012. However, ag-

gregate shareholder returns in 2013 amounted to 97.1%,

including dividends for 2012 financial results and interim

dividends for the first 9 months of 2013.

This reduction in dividend payout ratio was a one-off effect

due to the Group cashflow management. Finding the bal-

ance between the interests of shareholders and the needs

of the Company remains the core principle of the Compa-

ny’s dividend policy. We are committed to finding the opti-

mal balance in earnings distribution through dividends and

opportunities for the Company’s dynamic growth, which re-

quires increased investment into new projects and does not

rule out potential deals to acquire new core assets.

The Company is guided by the following Federal Laws re-

garding information disclosure: On the Securities Market,

On Joint-Stock Companies, On Counteracting the Ille-

gal Use of Insider Information and Market Manipulation,

On Making Amendments to Certain Laws of the Russian

Federation, and the Regulations on Information Disclosure

by Issuers of Securities (approved by order of the FSFR No.

11-46/pz-n dated 4 October 2011). We also comply with the

requirements of the exchanges on which our securities and

commodities are traded, other regulations and the require-

ments of the agreements we have concluded.

The Group’s corporate website

)

is a key information disclosure channel. It contains infor-

mation on all of the Group’s main areas of operation, sus-

tainable development policies, information for sharehold-

ers and investors, the latest press releases and news items,

annual reports and sustainability reports.

In addition to information posted in line with Group’s disclo-

sure obligations, the site is also updated quarterly with the

latest financial results, both IFRS and RAS.

To enhance disclosure, we keep the site regularly updated,

are constantly developing its structure and content, and

developing new interactive features. In 2013 we upgraded

the sections on the Company’s strategy and oilfields, and

started to develop interactive sections for the investor rela-

tions section of our website.

Key sources of information about the Company include An-

nual Report and the Sustainability Report, which we publish

each year ahead of the annual General Meeting of Share-

holders.

To improve information disclosure, all three sources – the

website, Annual Report (digital and print versions), and

Sustainability Report – are brought together in a single

information space. Additional links and cross-references

help the reader navigate the contents and find what they

are looking for quickly.

Systematic interaction with our shareholders and potential

investors is the Company’s highest priority. We make sure

we are in constant contact with the investor using every

means possible, from meetings with investors, investment

conferences and roadshows to site visits, analytical bulle-

tins and performance updates, in addition to informal cor-

porate events.

Senior management’s regular participation in one-on-one

meetings with investors and shareholders speaks to the

importance with which the Company views maintaining this

face-to-face contact. The investment community highly val-

ues this opportunity for direct dialogue with the Company’s

management.

Over the past three years we have substantially improved

the quality of our information disclosure. This was largely

thanks to increasing the number of meetings that members

of the Company’s top management held with analysts, in-

vestors, investment fund representatives and international

ratings agencies. These meetings took place the Company’s

offices, on the sidelines of international financial confer-

ences, via conference calls about the Company’s annual re-

sults, at press conferences, and at special on-site events for

leading fuel and energy sector analysts.

Information disclosure and investor relations

A considerate information disclosure policy covering all areas of the Company’s activity is one of the most impor-

tant tools for attracting potential investors. Our approach to information disclosure is underpinned by the following

key qualities: it must be regular, timely, accessible, trustworthy and substantive.

The regulations “On Information Policy at JSOC Bashneft” were approved by JSOC

Bashneft’s Board of Directors on 3 October 2011.

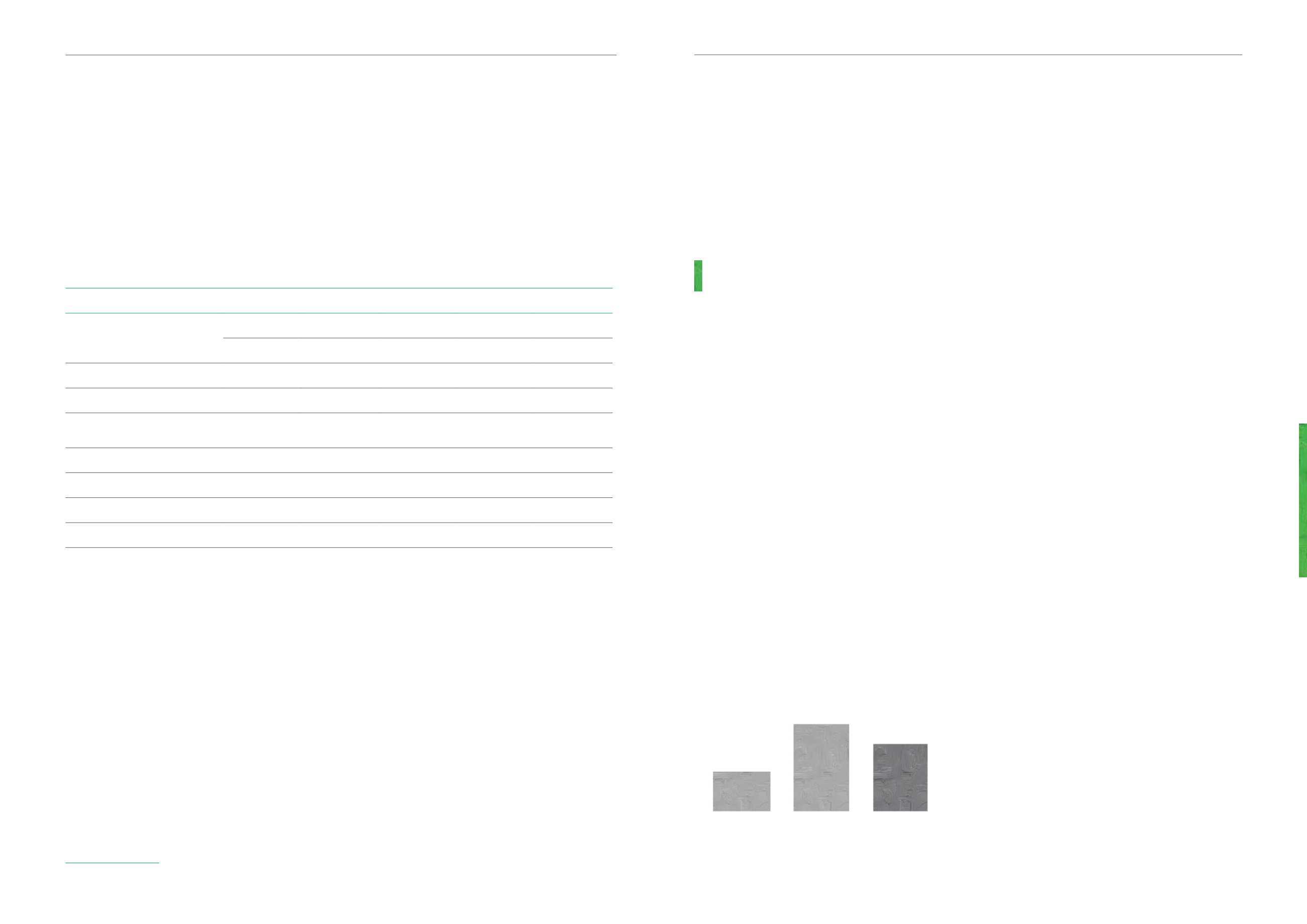

Number of press releases issued

126

277

214

2011

2012

2013